THE ARSENAL OF AUTONOMY

How Six Weeks Rewired the American Defense Industrial Base

A Forensic Analysis of Policy, Capital, and Power in Q1 2026

🎯 EXECUTIVE SUMMARY

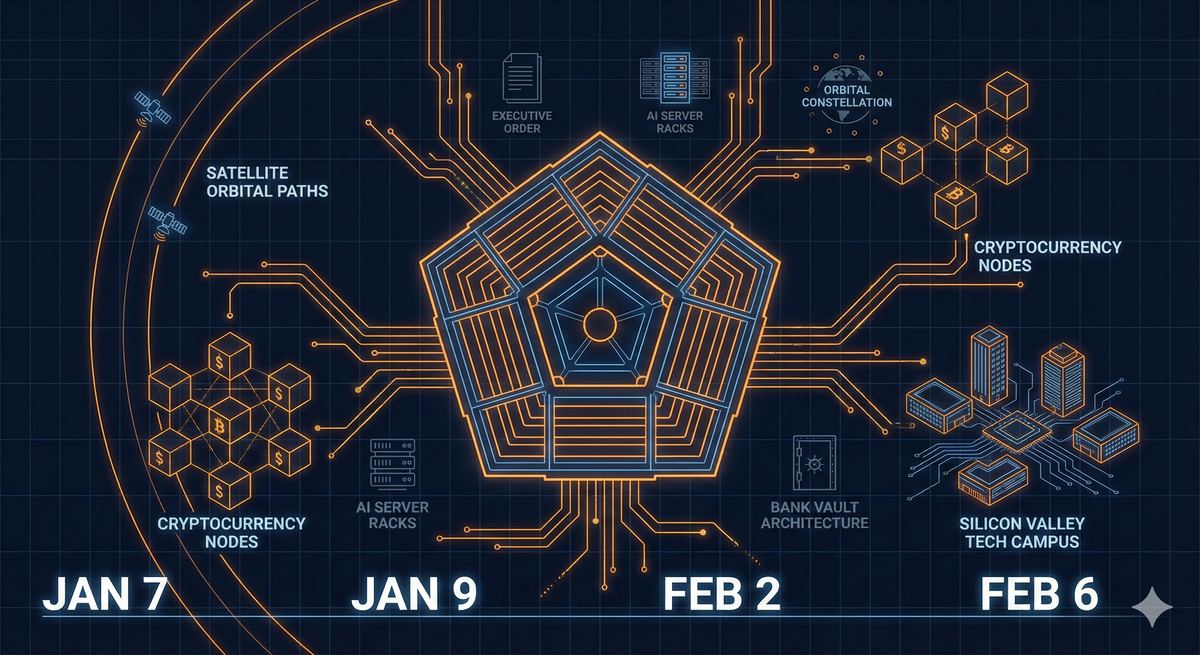

Between January 7 and February 6, 2026, the United States government executed a coordinated restructuring of its defense industrial base through seven documented actions: two executive orders restricting contractor capital allocation and streamlining arms exports, one Department of War AI strategy memorandum, one major aerospace-AI corporate merger valued at $1.25 trillion, and one national bank charter approval for a defense-focused fintech institution.

These events, occurring within a 30-day window, were preceded by the rescission of two national security memoranda governing arms transfer oversight and civilian harm assessment.

The Evidence:

This report presents the verifiable timeline, documents the structural connections between these actions, and analyzes their strategic implications. The evidence suggests these measures constitute not incremental policy adjustments but a systematic realignment designed to bypass legacy procurement constraints, eliminate ethical guardrails on military AI deployment, and create dedicated financial infrastructure for a new generation of defense technology companies.

The Method:

What follows is not speculation. It is a forensic reconstruction built from primary government documents, official fact sheets, regulatory filings, and contemporaneous reporting from major news outlets. Where connections are documented in official sources, they are labeled as such. Where they are inferred from timing, shared authority, or operational logic, that inference is made explicit.

📋 PART I: THE DOCUMENTED TIMELINE

This section presents seven Tier 1 events—actions verified by primary sources with exact dates, quoted language, and traceable authority. Each entry includes the source document title, URL, event classification, and explicit cross-references where official documents establish linkages.

Event 1: The Buyback Ban (January 7, 2026)

This executive order creates a contractor financial behavior restriction enforced through acquisition and securities regulatory mechanisms.

Primary Source: Executive Order 14372, "Prioritizing the Warfighter in Defense Contracting"

URL: https://www.whitehouse.gov/presidential-actions/2026/01/prioritizing-the-warfighter-in-defense-contracting/

Core Mechanism: The order states: "Effective immediately, they are not permitted in any way, shape, or form to pay dividends or buy back stock, until such time as they are able to produce a superior product, on time and on budget." It applies to major defense contractors and directs contract-related enforcement mechanisms tied to performance and production capacity.

The order assigns the Secretary of War authority to identify underperforming contractors and implement remediation requirements. Enforcement mechanisms explicitly include Defense Production Act (DPA) authorities, Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS) contract remedies, and coordination with the Securities and Exchange Commission regarding Rule 10b-18 safe harbor considerations.

Within 24 hours, Huntington Ingalls Industries—facing chronic delays in naval shipbuilding—signaled a halt to capital return programs.

"It's good to scare people sometimes."

— Palmer Luckey, founder of Anduril Industries, quoted by Business Insider

Event 2: The AI Strategy Memorandum (January 9, 2026)

This internal procurement directive binds future contracts for AI services through standardized clause language and vendor qualification criteria.

Primary Source: "Artificial Intelligence Strategy for the Department of War," signed by Secretary Pete Hegseth

URL: https://media.defense.gov/2026/Jan/12/2003855671/-1/-1/0/ARTIFICIAL-INTELLIGENCE-STRATEGY-FOR-THE-DEPARTMENT-OF-WAR.PDF

Core Directive: The memorandum states: "I direct the Under Secretary of War for Acquisition and Sustainment to incorporate standard 'any lawful use' language into any DoW contract through which AI services are procured within 180 days."

Deadline Calculation: January 9, 2026 + 180 days = July 8, 2026

"No models incorporating 'ideological tuning'"

"DEI and social ideology have no place in the DoW"

The memo explicitly requires procurement of AI models "free from usage policy constraints that may limit lawful military applications." It prohibits the use of models incorporating "ideological 'tuning'" and states: "Diversity, Equity, and Inclusion and social ideology have no place in the DoW, so we must not employ AI models which incorporate ideological 'tuning' that interferes with their ability to provide objectively truthful responses to user prompts."

The Seven Pace-Setting Projects:

The strategy identifies seven projects for fiscal year 2026:

- Swarm Forge — Autonomous drone coordination

- Agent Network — AI-enabled battle management

- Ender's Foundry — Simulation acceleration

These are framed as mechanisms for "accelerating DoW AI adoption" and "rapidly discovering and scaling new ways of fighting."

Operational Context: The Associated Press reported on January 12-13, 2026, that the Pentagon had begun deploying Grok (xAI's large language model) within the Pentagon network. This occurred three days after the "any lawful use" directive and twenty days before the SpaceX-xAI merger.

Event 3: The SpaceX-xAI Acquisition (February 2, 2026)

This transaction consolidates a defense-adjacent aerospace firm with an AI development company through equity exchange.

Primary Announcement: "xAI joins SpaceX," posted at https://x.ai/news/xai-joins-spacex

Confirmed by: Reuters, The Guardian (contemporaneous reporting)

Transaction Details: The acquisition valued the combined entity at $1.25 trillion, with SpaceX valued at $1 trillion and xAI at $250 billion. Reuters reported a disclosed share exchange ratio in subsequent coverage.

Technical Integration: Reporting referenced "the prospect of orbital data centers" as part of the combined entity's technical roadmap. On December 30, 2025—five weeks before the merger—Reuters had reported xAI purchased a third building and planned expansion of its Colossus supercomputer to "at least 1 million GPUs."

Defense Revenue Context: The U.S. Space Force awarded SpaceX task orders on January 12-13, 2026, for launches supporting Space Development Agency (SDA) and National Reconnaissance Office (NRO) missions. These awards occurred during the same week as Pentagon deployment of Grok and three weeks before the merger announcement.

Capital Flow Precedent:

- January 28, 2026: Tesla invested $2 billion in xAI (five days before SpaceX acquisition)

- March 28, 2025: xAI acquired X (formerly Twitter) in an all-stock deal

Event 4: The Erebor Bank Charter (February 6, 2026)

This regulatory approval grants preliminary conditional charter status to a de novo national bank targeting technology and defense sectors.

Primary Source: Office of the Comptroller of the Currency (OCC), "Conditional Approval Letter—Application to Charter Erebor Bank, National Association"

URL: https://occ.gov/news-issuances/news-releases/2025/nr-occ-2025-101a.pdf

Confirmed by: Reuters, Wall Street Journal (February 6, 2026 reporting)

- Technology Companies

- Ultra-High-Net-Worth Individuals

- Virtual Currency Users

Charter Details: The OCC letter grants preliminary conditional approval and states: "The Bank will be a full service insured national bank that plans to target its products and services to technology companies and ultra-high-net-worth individuals that utilize virtual currencies."

The letter identifies organizers and leadership roles, including "Palmer Luckey" listed as "Director, Principal Shareholder." Additional reporting described the bank as planning to serve technology businesses in sectors including "artificial intelligence" and "defense."

Event 5: The Arms Transfer Strategy (February 6, 2026)

This executive order restructures foreign military sales authority and export control processes through interagency task force coordination.

Primary Source: Executive Order, "Establishing an America First Arms Transfer Strategy"

URL: https://www.whitehouse.gov/presidential-actions/2026/02/establishing-an-america-first-arms-transfer-strategy/

Core Mechanism: The order directs agencies to "identify Foreign Military Sales (FMS) and Direct Commercial Sales opportunities that will support the strategic objectives of the America First Arms Transfer Strategy and the growth of the United States defense industrial base."

"New entrants and nontraditional defense companies"

PROCESS CHANGES- Streamline third-party transfer (TPT)

- Reduce approval friction

- Delegate authority to Secretary of War

It mandates process changes including "incentivizing new entrants and nontraditional defense companies to contribute to the defense industrial base" and directs streamlining measures such as reviewing third-party transfer processes "to reduce and potentially realign the onerous TPT process."

Authority Delegation: Section 36(a) of the order delegates substantial approval authority to the Secretary of War for certain categories of arms transfers, reducing the approval role previously held by the Department of State.

Documented Connection to Prior Actions: The White House fact sheet released with this order explicitly states it builds on:

- (a) A January 2025 executive order to modernize defense acquisitions

- (b) An April 2025 executive order to improve speed and accountability in foreign defense sales

- (c) "A January 2026 executive order aimed at stopping contractors from prioritizing buybacks and excessive corporate distributions over production capacity" — directly referencing Event 1

Events 6 & 7: The Policy Rescissions (February-March 2025)

These rescissions remove prior civilian harm assessment and conventional arms transfer frameworks from executive branch guidance.

Event 6 — NSM-20 Rescission (February 21, 2025)

Primary Source: GAO report GAO-25-107077, "HUMAN RIGHTS: State Can Improve Response to Allegations of Civilians Harmed by U.S. Arms Transfers"

The report states: "Additionally, on February 21, 2025, National Security Memorandum-20 (NSM-20) was rescinded."

NSM-20 Background: The GAO report describes NSM-20 as requiring written assurances from certain recipients regarding use of U.S. defense articles consistent with international humanitarian law. It describes a May 2024 report to Congress under NSM-20 addressing countries in active conflict, including findings that U.S.-origin defense articles were likely involved in incidents raising concern about Israel's compliance with human rights obligations.

Event 7 — NSM-18 Rescission (March 14, 2025)

Primary Source: White House document titled "Additional Rescissions of Harmful Executive Orders and Actions"

URL: https://www.whitehouse.gov/presidential-actions/2025/03/additional-recissions-of-harmful-executive-orders-and-actions/

The document lists "National Security Memorandum 18 of February 23, 2023 (United States Conventional Arms Transfer Policy)" among revoked actions.

"Policy void" — rescinded "without introducing a new policy to take its place"

The GAO report explicitly treats NSM-18 as the 2023 conventional arms transfer policy document and states: "In March 2025, the Trump administration rescinded the 2023 update… and State officials said they reverted to the 2018 policy."

Analysis from the Stimson Center characterized this rescission as occurring "without introducing a new policy to take its place," describing it as producing a "policy void" effect.

🔗 PART II: DOCUMENTED CONNECTIONS

This section identifies connections established by (a) explicit cross-references in official documents, (b) official fact sheets stating linkages, or (c) shared dates, delegated authorities, and mandated coordination. Additional synthesis is labeled as inference.

Connection 1: Buyback Ban → Arms Transfer Strategy

Type: Documented (explicit official reference)

The February 6, 2026 White House fact sheet for the Arms Transfer Strategy executive order states: "In January 2026, an executive order was signed to stop defense contractors from putting stock buybacks and excessive corporate distributions ahead of production capacity, innovation, and on-time delivery."

This is an explicit reference to the January 7, 2026 buyback ban (Event 1), establishing that the administration frames the arms export acceleration strategy as building on the capital discipline regime.

Connection 2: AI Strategy ↔ Buyback Ban

Type: Circumstantial (shared authority and timing)

Both documents assign substantial implementation authority to the Secretary of War and describe rapid process changes in defense policy domains. They were issued two days apart (January 7 and January 9, 2026).

While no explicit cross-reference exists between these documents, they share delegated authority structures and occurred in immediate sequence.

Connection 3: AI Strategy ← SpaceX-xAI Merger

Type: Circumstantial (product-policy alignment)

The acquisition combines a major aerospace defense contractor (SpaceX) with an AI developer (xAI) whose product (Grok) was deployed on Pentagon networks three days after the "any lawful use" directive.

The merger occurred 24 days after the AI strategy memorandum. xAI's public positioning as lacking "politically correct filters" aligns with the memorandum's prohibition on "ideological tuning."

The technical integration references "orbital data centers," overlapping the AI strategy's framework for AI infrastructure supporting military applications.

Connection 4: Erebor Bank ← SpaceX-xAI Ecosystem

Type: Circumstantial (sector focus and principal overlap)

The bank charter describes services targeting technology companies in sectors including "artificial intelligence" and "defense," placing it in the same operational ecosystem as the AI-and-aerospace consolidation.

- Anduril Industries (Founder)

- Erebor Bank (Principal Shareholder)

- Founders Fund (Investor)

- Backs: SpaceX, Anduril, Erebor

- Palantir (Co-founder)

- Erebor (Co-founder)

- 8VC (Head)

The national charter approval was reported on February 6, 2026—the same day as the Arms Transfer Strategy executive order.

Connection 5: NSM Rescissions ← Arms Transfer Strategy

Type: Documented (GAO analysis and timing)

The GAO report discusses both NSM-20 and NSM-18 rescissions in the context of arms transfer oversight and civilian harm assessment processes.

Both rescissions occurred in early 2025 (February 21 and March 14), nine to ten months before the February 6, 2026 Arms Transfer Strategy executive order.

The Stimson Center characterized the NSM-18 rescission as creating a "policy void," occurring "without introducing a new policy to take its place"—a characterization consistent with removing constraints before implementing an accelerated export framework.

⚙️ PART III: STRATEGIC IMPLICATIONS

The following analysis moves from documented facts to strategic interpretation. It synthesizes the timeline and connections to assess what these actions accomplish as a system.

The Capital Discipline Regime

The buyback ban represents a fundamental attack on the financial operating model of traditional defense contractors. For two decades, major primes have operated under a "harvest" strategy—extracting maximum cash flow and returning it to shareholders rather than reinvesting in production capacity.

The executive order prohibits this model for contractors identified as underperforming through contract-level enforcement mechanisms. It mandates a 15-day window for board-approved remediation plans, forces executive compensation to be tied to operational metrics rather than financial engineering, and authorizes salary caps during remediation periods.

The "HII Halt"—Huntington Ingalls' immediate capital return suspension—demonstrates the mechanism's effectiveness. Without a single formal enforcement action, the mere existence of the regulatory framework forced a major contractor to realign capital allocation with stated national priorities.

The AI Procurement Filter

The "any lawful use" mandate creates a binary selection mechanism for military AI vendors. Companies maintaining restrictive Acceptable Use Policies—OpenAI, Google, Anthropic—are effectively excluded from Department of War contracts after July 8, 2026.

These companies' current terms prohibit use of their models for weapons development, combat operations, and high-risk surveillance. OpenAI's usage policies explicitly state models cannot be used "to develop or use weapons." Anthropic's Constitutional AI framework restricts harmful applications including weapons development.

The "ideological tuning" prohibition further narrows the field. The memo directs the Chief Digital and AI Officer to establish "model objectivity" benchmarks within 90 days—a requirement that positions xAI's Grok as the standard-bearer while penalizing models with diversity-weighted training.

The strategic effect: Defense AI procurement will be dominated by vendors willing to support lethal applications without ethical friction.

The SpaceX-xAI merger occurred 24 days after this directive, combining the Pentagon's largest space contractor with an AI provider explicitly compatible with these requirements.

The Vertical Integration Play

The $1.25 trillion SpaceX-xAI combination creates a vertically integrated sovereign technology stack:

- Orbital launch capability

- Satellite deployment infrastructure

- AI compute at massive scale

- Defense-compatible AI models under unified control

The "orbital data centers" reference is technically significant. Training and operating frontier AI models requires enormous compute resources. Orbital deployment would enable:

- (a) Sovereign compute infrastructure beyond terrestrial regulatory jurisdiction

- (b) Direct satellite integration for real-time intelligence processing

- (c) Reduced latency for space-based command and control systems

The timing of Pentagon Grok deployment—three days after the "any lawful use" directive and twenty days before the merger—suggests operational testing preceded corporate consolidation.

The Financial Infrastructure Layer

Erebor Bank's charter as a "cryptocurrency-focused" national bank targeting "technology companies" in "artificial intelligence" and "defense" creates dedicated financial rails for this ecosystem.

Traditional banks face regulatory friction when handling cryptocurrency transactions or serving defense contractors with complex compliance requirements.

Strategic Functions:

- (a) Facilitating rapid capital deployment to defense technology startups

- (b) Enabling cryptocurrency-denominated transactions for international arms sales

- (c) Providing banking services to ultra-high-net-worth individuals in the defense-tech founder network

Palmer Luckey's role as principal shareholder connects Erebor directly to Anduril Industries, his defense technology company building autonomous weapons systems. Peter Thiel's Founders Fund backing of SpaceX, Anduril, and Erebor establishes capital linkages across the entire stack.

The Export Acceleration Framework

The Arms Transfer Strategy executive order completes the system by creating external demand signals. It directs agencies to identify FMS and Direct Commercial Sales opportunities, mandates streamlining of third-party transfer processes, and explicitly prioritizes "incentivizing new entrants and nontraditional defense companies."

Section 36(a)'s delegation of approval authority to the Secretary of War reduces the State Department's oversight role. Combined with the February and March 2025 rescissions of NSM-18 and NSM-20—which required human rights and civilian harm assessments—this creates a substantially deregulated export environment.

The $142 billion Saudi arms package announced in May 2025 provides context. That single deal—described as the "largest defense sales agreement in history"—occurred after the policy rescissions but before the formal export strategy framework. It suggests the rescissions immediately enabled transactions that previous oversight mechanisms would have slowed or prevented.

For "new entrants and nontraditional defense companies," this framework offers:

- (a) Simplified export approval processes

- (b) Reduced compliance burden from removed human rights assessments

- (c) Explicit government support for capturing foreign military sales opportunities

The Silicon Valley Defense Network

These events reveal a coherent network of individuals, companies, and capital flows:

Peter Thiel: Founders Fund backs SpaceX, Anduril, and Erebor Bank. Co-founder of Palantir, the data analytics platform embedded in intelligence operations.

Elon Musk: Controls SpaceX (orbital infrastructure) and xAI (AI models). Primary beneficiary of the "any lawful use" procurement directive and potential orbital data center policies.

Palmer Luckey: Founder of Anduril (autonomous weapons) and principal shareholder of Erebor Bank (financial infrastructure). Quoted saying "it's good to scare people sometimes" regarding the buyback ban.

Joe Lonsdale: Co-founder of Palantir and Erebor, head of 8VC venture capital. Connects intelligence community data capabilities with the emerging defense financial infrastructure.

Pete Hegseth & Emil Michael: As Secretary of War and Under Secretary for Research & Engineering, they translate network objectives into policy. Emil Michael, former Uber executive, represents importation of Silicon Valley "growth" methodology into Pentagon acquisition.

This is not a conspiracy. It is a documented network of capital, technical capability, and policy authority operating in coordinated fashion across multiple domains.

🎯 CONCLUSION: THE NEW IRON TRIANGLE

The classical "iron triangle" of defense policy consisted of Congress, the Pentagon bureaucracy, and traditional prime contractors. That triangle operated through multi-year appropriations cycles, cost-plus contracting, and distributed manufacturing across congressional districts.

The events documented in this report suggest a different architecture:

Vertically integrated, founder-led technology firms (SpaceX-xAI, Anduril, Palantir) replacing distributed primes with concentrated capability stacks

FINANCIAL ENGINEDedicated, cryptocurrency-native banking infrastructure (Erebor) replacing traditional defense banking relationships with rapid capital deployment mechanisms

REGULATORY FRAMEWORKExecutive branch utilizing DPA authorities, acquisition rule modifications, and export delegation to discipline legacy contractors and accelerate new entrants

This system is designed to be self-reinforcing:

The buyback ban forces traditional contractors to reinvest in production, creating space for new entrants operating under different capital models.

The AI strategy excludes vendors with usage restrictions, channeling procurement toward ideologically aligned providers.

The arms export framework generates external demand, justifying the capital expenditures mandated by the buyback restrictions.

The financial infrastructure enables rapid scaling of favored companies through cryptocurrency-native capital markets.

The rescission of NSM-18 and NSM-20 removed human rights oversight mechanisms nine to ten months before the export acceleration framework was formalized. The Stimson Center's characterization—a "policy void" created by rescinding guidance "without introducing a new policy to take its place"—describes not an oversight but a deliberate sequencing.

Constraints were removed before the accelerated system was activated.

⚠️ WHAT THIS MEANS

By July 8, 2026—the 180-day deadline for "any lawful use" contract language—the Department of War will have implemented procurement rules that exclude major commercial AI providers and favor defense-compatible alternatives.

Anduril's Arsenal-1 facility in Ohio, covering 5 million square feet and designed for 4,000 workers, is scheduled to begin production in July 2026—the same month.

The SpaceX-xAI entity, valued at $1.25 trillion, controls orbital launch, satellite deployment, AI compute infrastructure, and defense-compatible AI models. The combination occurred after Pentagon deployment of Grok and simultaneous with Space Force contract awards.

Erebor Bank holds a national charter to serve this ecosystem with cryptocurrency-native financial services, backed by principals who also control major defense technology companies.

The arms export framework explicitly prioritizes "new entrants and nontraditional defense companies," with streamlined approval processes and reduced oversight requirements resulting from the NSM rescissions.

This is not incremental reform.

It is architectural replacement—trading the compliance-focused, geographically distributed, congressionally constrained defense industrial base

for a founder-led, vertically integrated, executively empowered alternative

❓ THE QUESTIONS THAT REMAIN

This report documents what happened and establishes documented connections. It does not—cannot—prove intent.

The White House fact sheet explicitly links the buyback ban to the arms export strategy. The timing is documented. The network is verifiable. The technical requirements align.

But documentation of sequence and connection is not documentation of coordination. That would require internal communications, strategy memos, and planning documents not available in the public record.

What can be stated with certainty:

- Seven documented actions occurred within a 30-day window in early 2026

- These actions, taken together, accomplish a systematic realignment of defense industrial base incentives, procurement rules, export frameworks, and financial infrastructure

- A coherent network of individuals, companies, and capital flows occupies strategic positions across the resulting architecture

- Human rights oversight mechanisms were removed nine to ten months before the export acceleration framework was formalized

- The resulting system is self-reinforcing: external demand justifies capital discipline, capital discipline creates space for new entrants, procurement rules favor those entrants, and financial infrastructure accelerates their scaling

Whether this represents masterful strategic planning or opportunistic convergence, the effect is identical:

The United States defense industrial base has been fundamentally restructured in six weeks.

THE NEW ERA

THE ERA OF THE PRIME CONTRACTOR IS ENDING Legacy defense primes optimized for congressional appropriations cycles, cost-plus contracts, and geographically distributed manufacturing face systematic displacement. THE ERA OF THE SOVEREIGN TECH CONGLOMERATE HAS BEGUN Founder-led, vertically integrated technology firms operating under unified executive control with cryptocurrency-native financial infrastructure now occupy strategic positions across the defense industrial base.📚 APPENDIX: PRIMARY SOURCE INDEX

This appendix lists all primary government documents, official fact sheets, and major news outlet reporting cited in this analysis. Each entry includes document title, publication date, and URL.

Executive Orders & White House Documents

Executive Order 14372, "Prioritizing the Warfighter in Defense Contracting" (January 7, 2026)

https://www.whitehouse.gov/presidential-actions/2026/01/prioritizing-the-warfighter-in-defense-contracting/

Executive Order, "Establishing an America First Arms Transfer Strategy" (February 6, 2026)

https://www.whitehouse.gov/presidential-actions/2026/02/establishing-an-america-first-arms-transfer-strategy/

"Additional Rescissions of Harmful Executive Orders and Actions" (March 14, 2025)

https://www.whitehouse.gov/presidential-actions/2025/03/additional-recissions-of-harmful-executive-orders-and-actions/

Department of War Documents

"Artificial Intelligence Strategy for the Department of War" (January 9, 2026)

https://media.defense.gov/2026/Jan/12/2003855671/-1/-1/0/ARTIFICIAL-INTELLIGENCE-STRATEGY-FOR-THE-DEPARTMENT-OF-WAR.PDF

Regulatory Agency Documents

OCC, "Conditional Approval Letter—Application to Charter Erebor Bank, National Association" (October 15, 2025)

https://occ.gov/news-issuances/news-releases/2025/nr-occ-2025-101a.pdf

GAO-25-107077, "HUMAN RIGHTS: State Can Improve Response to Allegations of Civilians Harmed by U.S. Arms Transfers"

https://www.gao.gov/assets/880/877102.pdf

Corporate Announcements & Major Reporting

xAI, "xAI joins SpaceX" (February 2, 2026)

https://x.ai/news/xai-joins-spacex

Reuters, "Musk's SpaceX to merge with xAI in combined valuation of $1.25 trillion" (February 2, 2026)

https://www.reuters.com/business/musks-spacex-merge-with-xai-combined-valuation-125-trillion-bloomberg-news-2026-02-02/

Wall Street Journal, "Hobbit-Inspired Startup Becomes First New Bank Greenlighted by Trump 2.0" (February 6, 2026)

https://www.wsj.com/finance/banking/hobbit-inspired-startup-becomes-first-new-bank-greenlighted-by-trump-2-0-0d6075ef

END OF REPORT